Finance Process Automation

Streamlining Loan Approval Processes with Intelligent Process Automation: A Guide for Lenders

The financial services industry is at a period of radical change. Lenders are faced with pressure to be faster at loan processing while maintaining compliance and ensuring a highly satisfactory customer experience. To meet such requirements, more than the manual traditional approaches are required. That's where Decisions, an industry-leading no-code automation and business rules engine, comes in. Intelligent Process Automation, or IPA, can help lenders to become more efficient and effective while improving compliance for loan approvals.

At TechMarcos, we specialize in finance automation by implementing and customizing solutions on the Decisions platform to help lenders overcome their most significant challenges. Here's how Decisions, along with our expertise, can transform lending operations.

Challenges in Traditional Lending

Loan approval is a tedious and time-consuming process. Some of the common pain points are:

Loan approval is a tedious and time-consuming process. Some of the common pain points are:

Slow Processing Times

Manual document handling and data entry lead to delays, frustrating borrowers.

High Risk of Errors

Mistakes in borrower data or calculations can lead to loan rejections or regulatory issues.

Regulatory Compliance

Compliance with changing regulations may involve significant resources for manual audits on a lender's part.

Disconnected Systems

Legacy tools fail to integrate seamlessly, leading to inefficiencies and data silos.

How Decisions and TechMarcos Transform Lending?

The Decisions platform integrates powerful automation with no-code. This is what empowers lenders to solve such problems. Here's how it is done:

- Loan Approvals from End to End

With Decisions, the loan lifecycle is completely automated. TechMarcos' team configures the workflow that automates collection, validation, and risk assessments. The result is dramatically shorter approval times.

- Advanced Risk Assessment via Decision Rules

Decisions' no-code credit risk model makes building complex credit risk models possible for a user. TechMarcos is also there in ensuring lenders have the custom-fit decision rules to ascertain just and fair evaluations.

- Easy Compliance

Decisions boasts compliance tools that always apply rules in every given workflow step. TechMarcos always configures your workflows as compliance friendly for both countrywide and international standards, in addition to peace of mind after any audit.

- Seamless Integration with Other Systems

Decisions is easily integrated with third-party systems, including credit bureaus, CRMs, and payment gateways. TechMarcos has the expertise in customizing these integrations to ensure smooth data exchange between platforms.

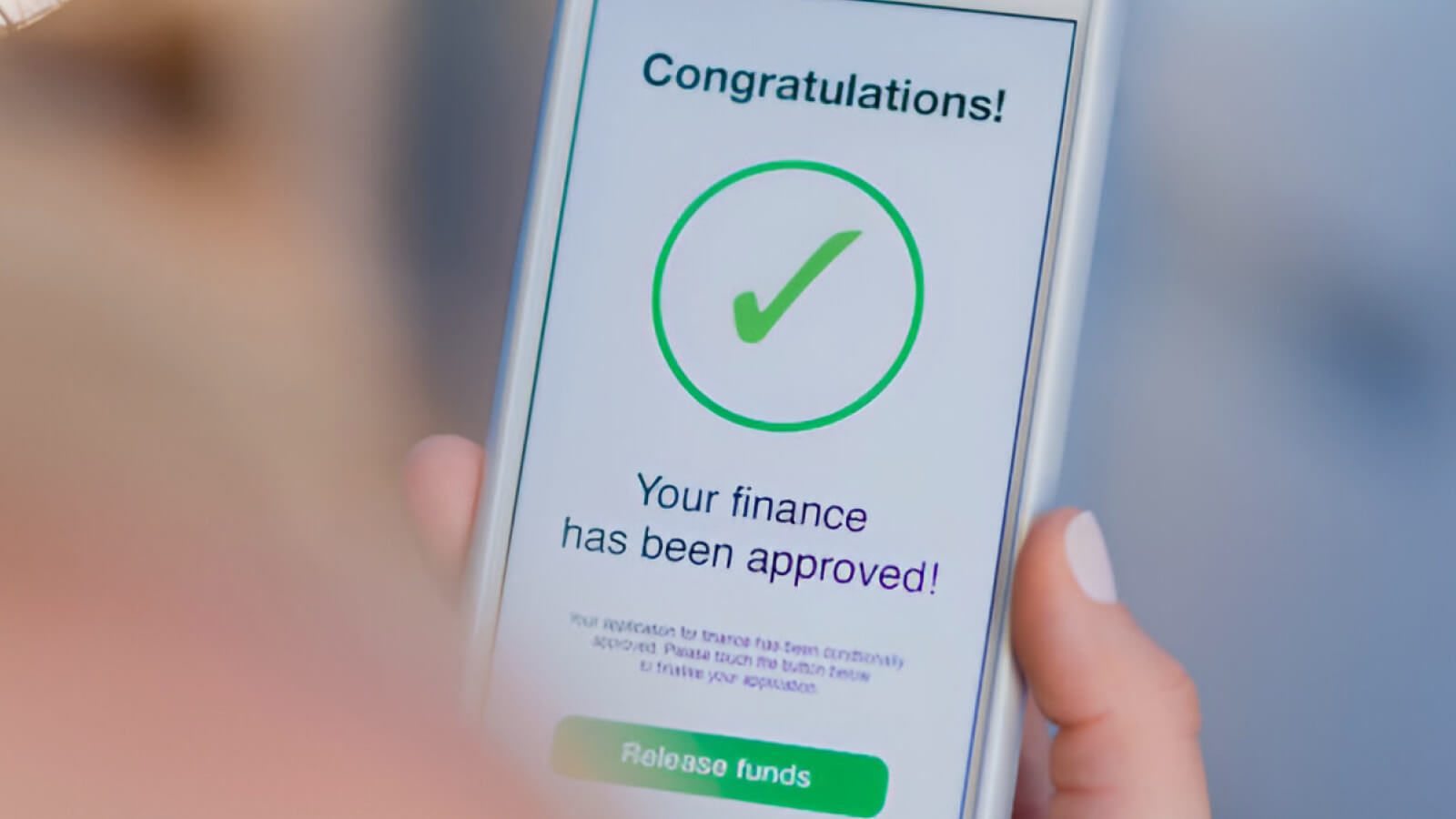

- Enhancing Customer Experience

Automating processing, real-time updates, and personalized communications will make the borrowers happy. With TechMarcos, lenders can customize borrower-facing forms and communication channels for an excellent user experience.

The TechMarcos Advantage

While Decisions will give you the tools, TechMarcos will make them work to their optimum capacity. Here's what we bring to the table:

While Decisions will give you the tools, TechMarcos will make them work to their optimum capacity. Here's what we bring to the table:

Customization:

Tailoring Decisions' workflow, decision rules, and integration to meet your distinct business needs.

Implementation support:

From setting up and starting to full-scale, we ensure a smooth move into automation.

Ongoing Optimization:

TechMarcos continues to optimize your process in response to changing rules and regulations or shifts in your business.

Process Automation:

With the experience in financial process automation services, we understand the unique challenges lenders have and provide targeted solutions.

Benefits of Automation with Decisions and TechMarcos Expertise

Faster Loan Approvals

Automating manual workflows accelerates processing, helping lenders handle higher volumes without additional resources.

Improved Accuracy

Rule-based decision-making ensures consistent and error-free evaluations, enhancing trust and compliance.

Faster Loan Approvals

Automation of manual workflows accelerates processing, so lenders can handle more volume without having to add more resources.

Improved Accuracy

Rule-based decision-making ensures consistent and error-free evaluations, enhancing trust and compliance.

Regulatory Confidence

Integrated compliance checks ensure that the institution adheres to regulations, reducing audit-related risks.

Cost Efficiency

Streamlined operations reduce overheads and better resource allocation.

Scalable Solutions

Whether regional or global, Decisions and TechMarcos deliver scalable solutions tailored to your growth.

How to get started with your Path to Modern Lending With Process Automation ?

Here's how to get started on your automation journey:

Step 1: Identify Pain Points

Plot out your existing loan approval process and highlight pain points.

Step 2: Partner with Experts

Leverage the expertise of TechMarcos to implement and customize the Decisions platform according to your unique needs.

Step 3: Test and Optimize

Begin with a pilot program that refines workflows and produces measurable insights before scaling.

Step 4: Scale Across Operations

Automation of other lending areas, such as compliance management or borrower communication, should be done for full benefits.

Process Automation

Why Choose Decisions and TechMarcos?

The lending industry is changing rapidly, and automation is no longer optional—it’s essential. The Decisions platform, with its no-code environment and robust automation capabilities, empowers lenders to stay competitive. With TechMarcos as your partner, you’ll receive expert guidance to implement, optimize, and scale these solutions for maximum impact.

Are you ready to transform your lending operations?  Contact TechMarcos today to schedule a personalized consultation and see how the Decisions platform can revolutionize your loan approval processes.

Contact TechMarcos today to schedule a personalized consultation and see how the Decisions platform can revolutionize your loan approval processes.