Low-Code/No-Code Development

Low-Code/No-Code Development

Underwriting policy is one of the critical processes in the insurance industry. It determines the risk associated with the coverage of a potential client and defines the terms for coverage, including premiums, conditions, and exclusions. Traditionally, this process has been labor-intensive, prone to errors, and manual. Insurers depend heavily on significant paperwork, data entry, and manual decision-making, which prolongs the underwriting process, increases costs, and impacts customer satisfaction. Now more than ever, a faster, more accurate, and streamlined policy underwriting is a need in an insurer.

Low-code/no-code automation becomes a game changer for insurers to automate complex workflows, integrate important data, and accelerate the processing of risk assessments. Through these, underwriting will be made simple, with improvements in accuracy as well as greater operational efficiency in general.

The Challenge of Time-Consuming and Manual Underwriting Processes

This process of underwriting is a long, manual one, covering all these steps: information gathering from various sources, comparison of those risks as per preset rules, cross-verification of information, and then policy acceptance. These all involve much human intervention, repetition, and handling of documents. All of these inefficiencies lead to delay, higher operational costs, and a longer time to turn the response back to customers.

Insurers are always compelled to accelerate the underwriting process with accuracy and a lookout for compliance with evolving regulatory standards. Processing applications delayed can cause dissatisfaction and impair the competitive survival of an insurer in the market.

Manual underwriting is a multi-step process wherein data is gathered from various sources, evaluating the different risks according to predefined rules, cross-verifying the same, and finally reaching decisions on policy acceptance. All these involve human intervention in a lot of repetitive tasks as well as manual handling of documents. All these inefficiencies resulted in delays, increased operational costs, and longer turnaround times for customers.

The insurers have to constantly update themselves with increased speed in underwriting without compromising accuracy and meeting changing regulatory standards. If the processing delay impacts the customer satisfaction level, then this also impairs the competitiveness of an insurer in the market.

How Low-Code/No-Code development is Reshaping Policy Underwriting

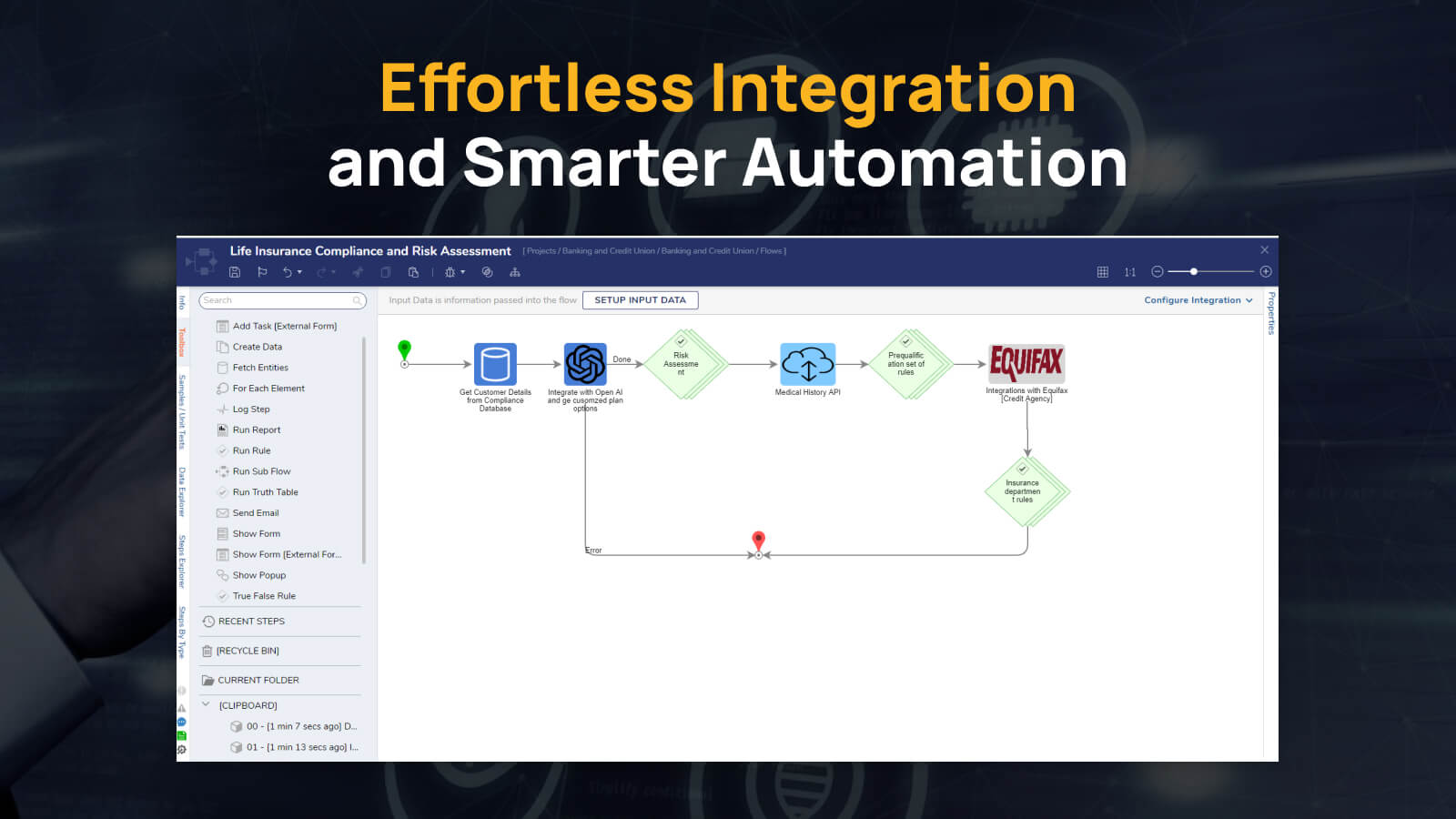

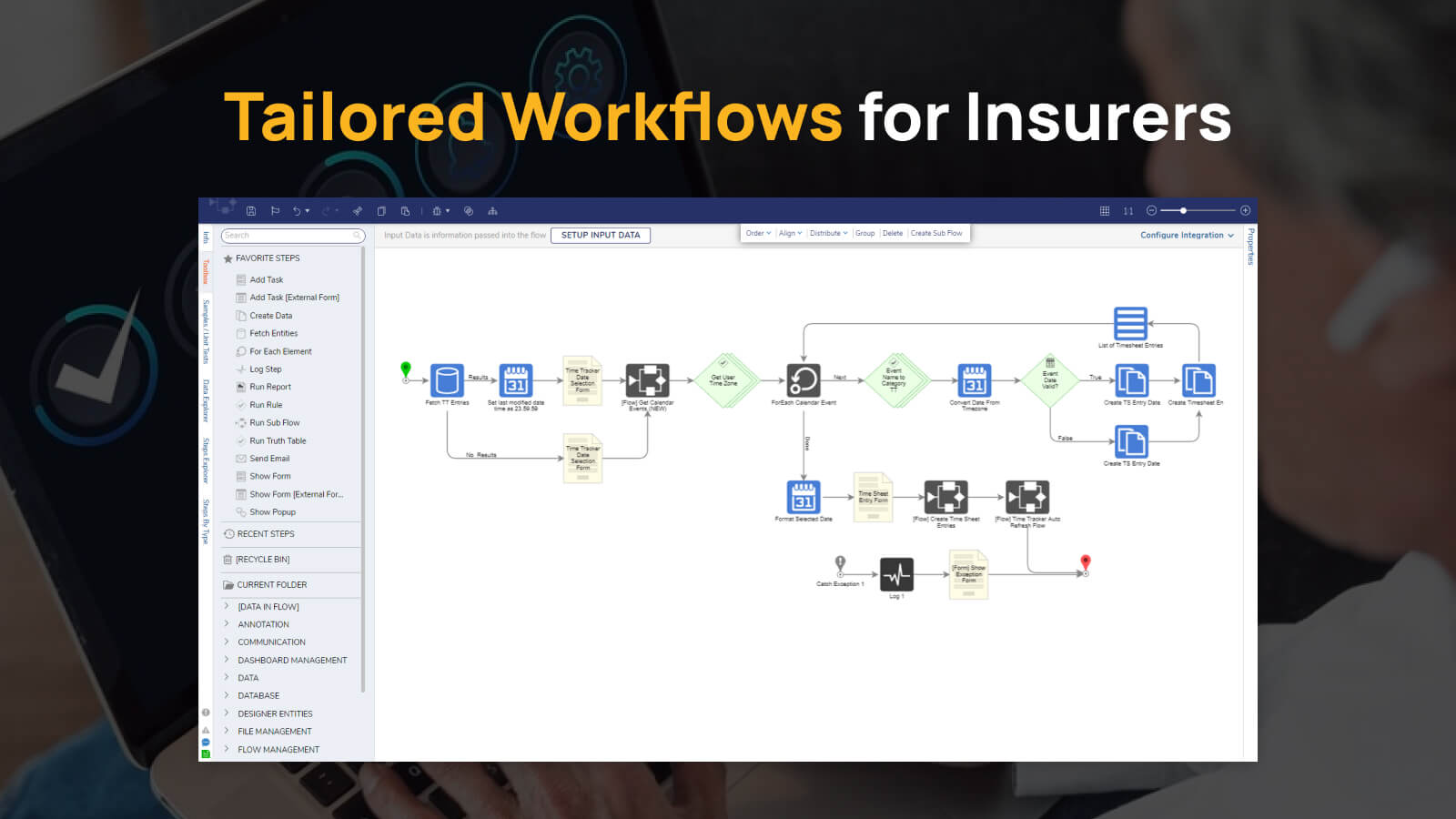

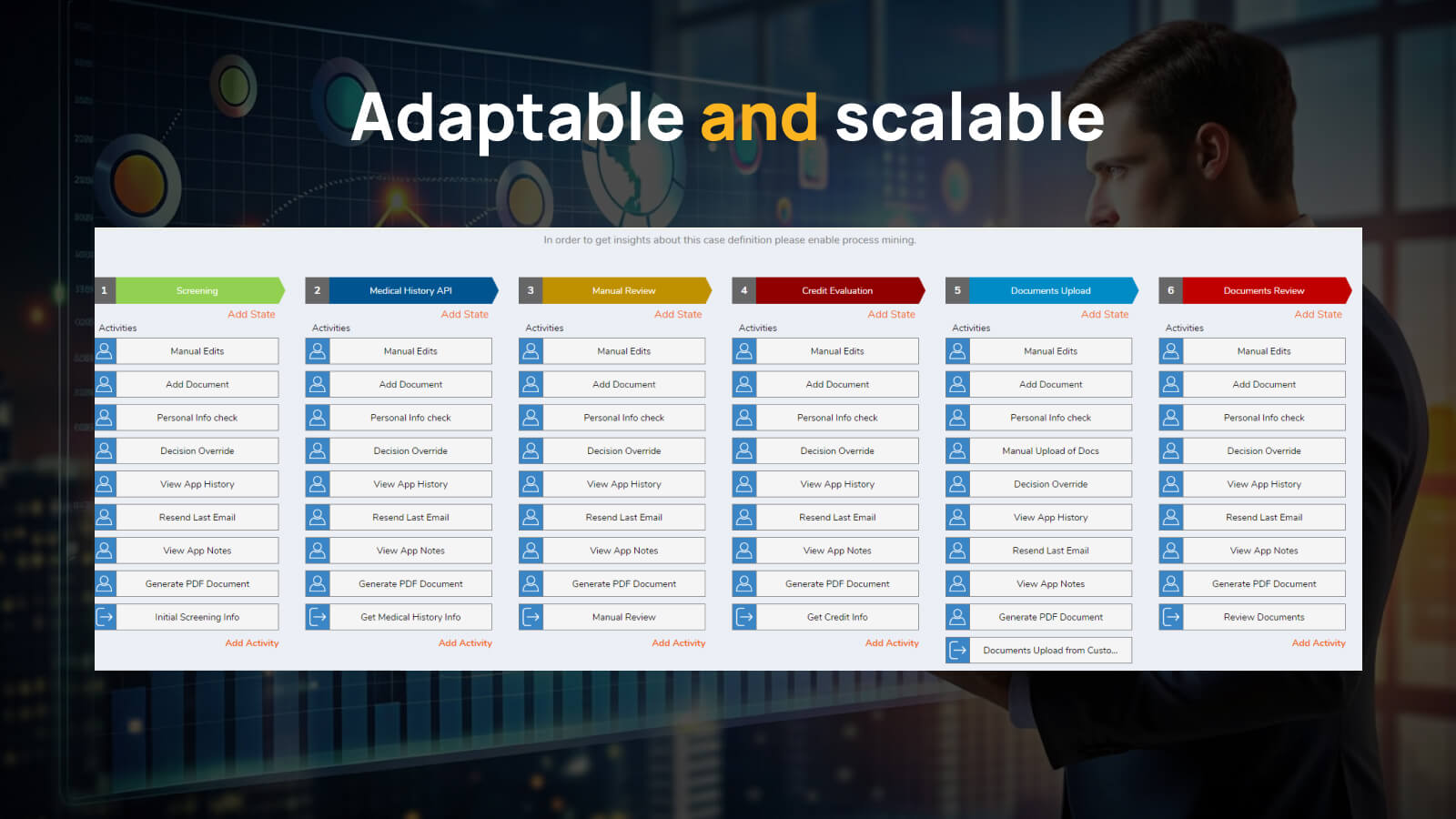

Low-code/no-code automation tools have revolutionized traditional underwriting by simplifying workflows and automating repetitive, time-consuming tasks. Platforms are provided with user-friendly interfaces, visual development environments, and drag-and-drop functionality, enabling insurers to design workflows without extensive coding expertise. With low-code/no-code automation, insurers can create scalable and flexible underwriting solutions that streamline operations and enhance decision-making.

Key Features of Low-Code/No-Code Automation in Policy Underwriting:

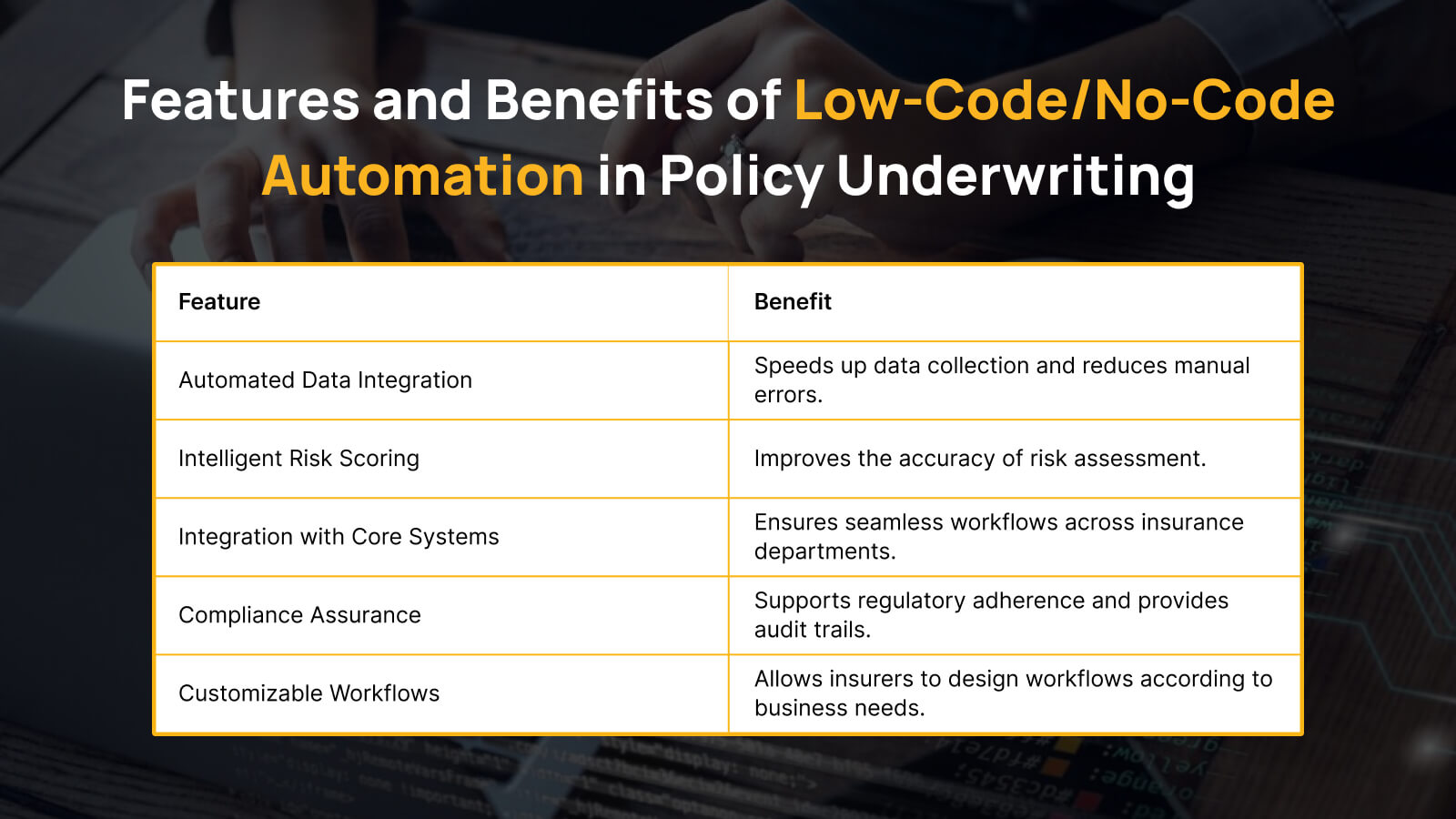

Automated Data Collection: Low-code platforms enable insurers to collect and integrate data from various sources, such as online applications, third-party data providers, and legacy systems. This significantly reduces the time spent on manual data entry.

Intelligent Risk Scoring: Automation tools apply machine learning algorithms to analyze data and generate risk scores. These tools evaluate multiple factors quickly and accurately, improving the accuracy of risk assessment and helping insurers make better decisions faster.

- Seamless System Integration: Low-code platforms connect underwriting workflows with core insurance systems, such as Electronic Health Records (EHR), customer relationship management (CRM), and claims management systems. This ensures that information flows seamlessly across different departments.

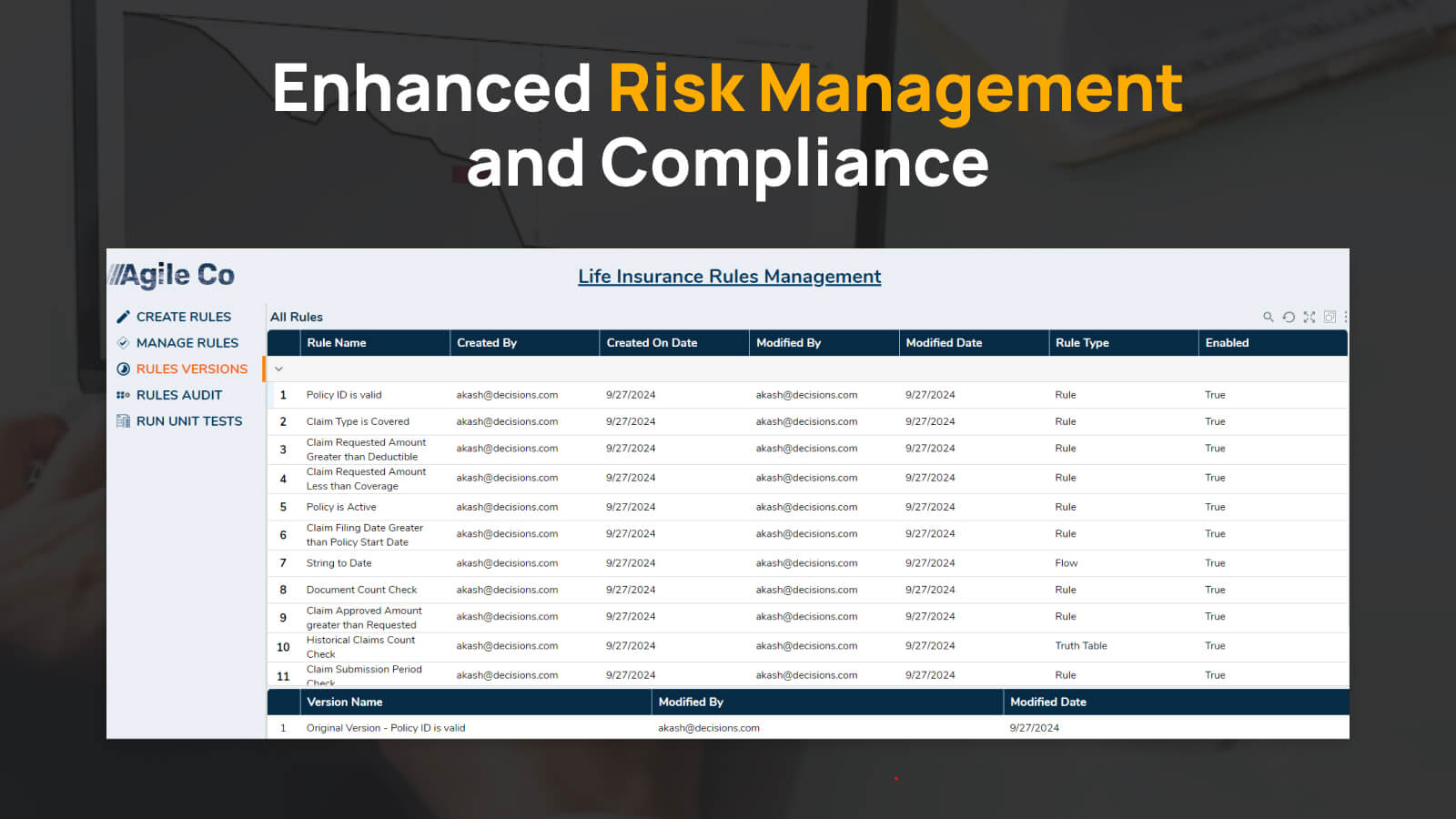

- Compliance Automation: Low-code/no-code automation helps insurers maintain compliance by enforcing predefined rules and providing audit trails that ensure all underwriting processes adhere to industry regulations.

The Role of Low-Code Development in Building Tailored Underwriting Solutions

Low-code development takes the power of automation a step further by enabling insurers to build customized applications that meet specific business needs. Unlike no-code platforms, low-code development allows greater flexibility in tailoring workflows, integrating external systems, and designing bespoke applications that reflect unique underwriting models and risk evaluation criteria.

Benefits of Low-Code Development in Underwriting:

Customization to Business Needs: Low-code development allows insurers to design workflows that align precisely with their specific underwriting processes, risk management strategies, and regulatory requirements.

- Faster Deployment: Insurers can quickly deploy new products or adjust existing underwriting tools to market demands without lengthy development cycles.

- Scalability: With low-code development, insurers can scale underwriting solutions as their business grows, handling increasing policy volumes without the need for significant reinvestment in infrastructure.

- User-Friendly Applications: Low-code development tools prioritize intuitive interfaces, ensuring that both technical and non-technical users can adopt the solutions easily.

Advantages of Automating Policy Underwriting with Low-Code/No-Code development

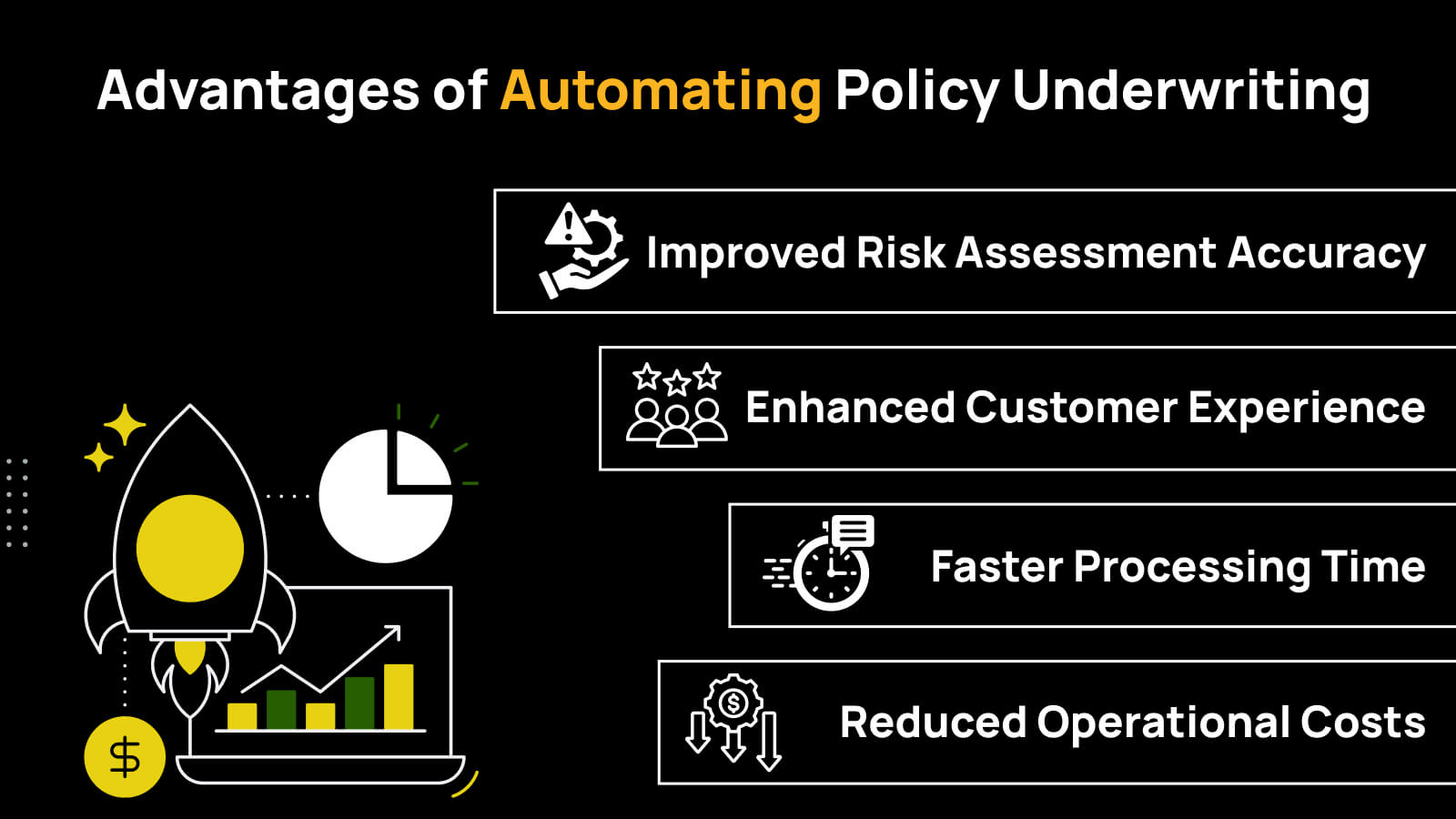

The integration of low-code/no-code automation into underwriting brings significant advantages to insurance companies, transforming their operations and decision-making processes:

- Faster Processing Time: By automating repetitive steps, insurers can significantly reduce the time required to process applications and issue policies.

- Reduced Operational Costs: Automation minimizes the need for manual intervention, thereby reducing administrative overhead and allowing insurers to allocate resources more efficiently.

- Improved Risk Assessment Accuracy: Machine learning algorithms and intelligent data analysis ensure that risk assessment is more precise, leading to better-informed underwriting decisions.

- Enhanced Customer Experience: Faster processing and streamlined workflows lead to a better customer experience, as clients receive quicker responses and smoother interactions during the application process.

Source: Insurance Technology News

Conclusion: Embrace Advanced Automation for Faster and More Accurate Policy Underwriting

This fast-evolving industry for insurance involves trying smarter ways in operational efficiency to cut turnaround time and improve the experience of their customers. Through low-code/no-code automation, the insurance industries are reaching these goals by streamlining the policy underwriting process and data integration coupled with advanced methods for risk evaluation.

Advanced automation tools by TechMarcos enable insurers to adopt low-code/no-code technologies for transforming underwriting workflows. Intuitive tools and scalable applications allow insurers to provide faster, more accurate underwriting decisions while maintaining compliance and enhancing customer satisfaction.

By embracing such cutting-edge automation solutions, the insurer can present itself as the leader in a competitive landscape: efficient, cost-effective, and accurate underwriting processes that leave others behind.

Advanced Automation for Faster and More Accurate Policy Underwriting

To stay competitive in this current landscape, speed, accuracy, and efficiency have become an insurance imperative. Manual underwriting tasks, along with the duplication of data inputting, clog the very system meant to be speedy for quick decision-making. This could ultimately leave customers in a frustrated waiting state. Using low-code/no-code automation platforms would open opportunities to overhaul such underwriting workflows into smoother, better performing, and efficient operations.

Low-code/no-code automation automates routine tasks, applies intelligent data analysis, integrates with core systems, and ensures compliance-all while allowing insurers to design customized underwriting workflows tailored to their specific needs. This approach not only accelerates the underwriting process but also ensures accuracy, reduces errors, and enhances the customer experience.

Through the implementation of sophisticated automation technology such as those offered by TechMarcos, underwriting insurance would unlock their entire potential with much faster, better-informed decision-making and increased operation excellence.

Ready to transform your policy underwriting with advanced automation?

Discover how TechMarcos can help your insurance company implement low-code/no-code automation solutions to streamline your workflows, enhance accuracy, and speed up underwriting processes.

Contact us today to learn more and take the first step toward more efficient, customer-centric underwriting.